More Leads. Better Quality. Faster Conversions.

We really enjoyed working with the team. They are very easy-going and communicative. Of course, we were most impressed by the results — great job done!

52

high-quality meetings

52

high-quality meetings

Your Lead Engine, Built for Loans: Tabbed Solutions for Loan Lead Growth

Precise Lead Targeting

We help you define borrower profiles by salary, business size, asset type, or credit purpose.

Loan-Focused Qualification Flows

From lead forms to phone validation, we build pre-screening systems that save your sales team time.

Ad Funnels That Deliver

Facebook, Google, LinkedIn & landing pages crafted for high-intent users and form completions.

Multi-Channel Outreach

Reach potential borrowers via WhatsApp DMs, SMS, email, or calendar bookings for consultations.

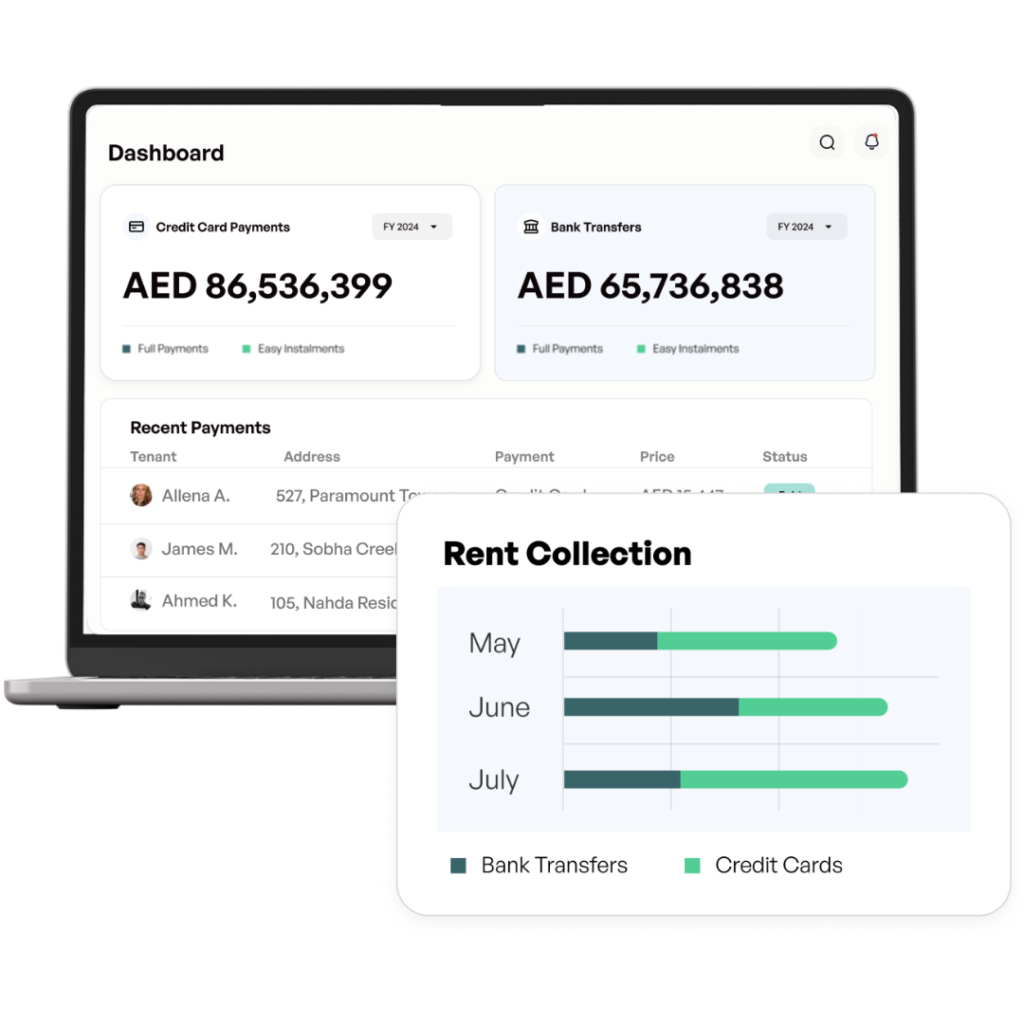

CRM Sync + Alerts

We integrate with your tools or set up custom dashboards — so your team never misses a warm lead.

Audience Targeting

We help you define borrower profiles by salary, business size, asset type, or credit purpose.

Lead Qualification

From lead forms to phone validation, we build pre-screening systems that save your sales team time.

Paid Campaigns

Facebook, Google, LinkedIn & landing pages crafted for high-intent users and form completions.

WhatsApp & Email Outreach

Reach potential borrowers via WhatsApp DMs, SMS, email, or calendar bookings for consultations.

CRM & Real-Time Alerts

We integrate with your tools or set up custom dashboards — so your team never misses a warm lead.

Lead Generation Services for Loan Agencies Across Sectors

Leads for loans, credit, mortgages, and finance products across B2C and B2B segments.

Award-winning B2B sales agency

Clutch /

4.9 score

G2 /

4.9 score

Upcity /

5.0 score

Say Goodbye to Cold Traffic and Generic Leads

Solve Your Loan Lead Generation Bottlenecks

Low-Quality or Unverified Leads

We qualify each lead based on your loan product, income threshold, location, and borrowing intent.

Slow Lead Flow

We automate outreach and ad funnels to keep a steady pipeline of prospects flowing into your calendar.

Funnel Inefficiencies

Get more inquiries turned into applications with tested landing pages, pre-qualification questions, and fast follow-up

Why Loan Agencies Choose Us for Lead Generation

A Growth Engine for Lending Professionals

Multi-Lending Expertise

We know how to market personal, business, mortgage, and auto loan offers — with unique strategies per product.

Performance-Based or Monthly Plans

Pay-per-lead or retainer — flexible pricing to match your deal cycle and conversion process.

Lead Filtering That Works

Income level, loan amount, intent, region — we filter out noise so your team only works warm leads.

Real-Time Delivery

Leads are delivered instantly to your inbox, CRM, or calendar so follow-ups happen while interest is fresh.

End-to-End Campaign Management

We handle everything from outreach to booking — your job is to fund qualified borrowers.

Ready to Close More Deals, Not Chase Cold Leads?

Partner with a trusted loan agency lead generation company and scale your deal flow.

Lead Generation Before vs. After Working With Us

Go from cold outreach and low conversion to warm, ready-to-book loan applicants.

Before Leadee

Appointment Booking

With Leadee

Lead Generation for Loan Companies (FAQs)

Do you work with personal or business loan firms?

Both — we generate B2C and B2B loan leads for agencies, brokers, NBFCs, and consultants.

Can I choose the type of loan applicants I want?

Yes — we qualify leads based on your ideal borrower (income, loan type, location, etc.).

Do you offer shared or exclusive leads?

We can geo-target any region — UAE, GCC, India, SEA, or global depending on your offer.

What countries do you support?

We can geo-target any region — UAE, GCC, India, SEA, or global depending on your offer.

What’s the typical timeline to get results?

Most clients start getting qualified leads within 2–3 weeks after campaign kickoff.

Can you integrate with our CRM?

Yes — we support most CRMs, Google Sheets, and booking tools for full sync.

Are your campaigns compliant with data laws?

100%. We’re fully GDPR, CCPA, and TCPA-compliant for global financial lead gen.

How does pricing work?

Options include performance-based (pay-per-lead) or retainer-based models.

FAQ Repeater

Start Getting Loan Inquiries That Actually Convert

Whether you serve individuals, SMEs, or high-ticket borrowers — we’ll deliver verified, ready-to-convert loan leads.